The following was written by Royce Millar, Ben Schneiders for the Canberra Times (6 April 2017) and expresses concern about tax minimization for well off Australian.

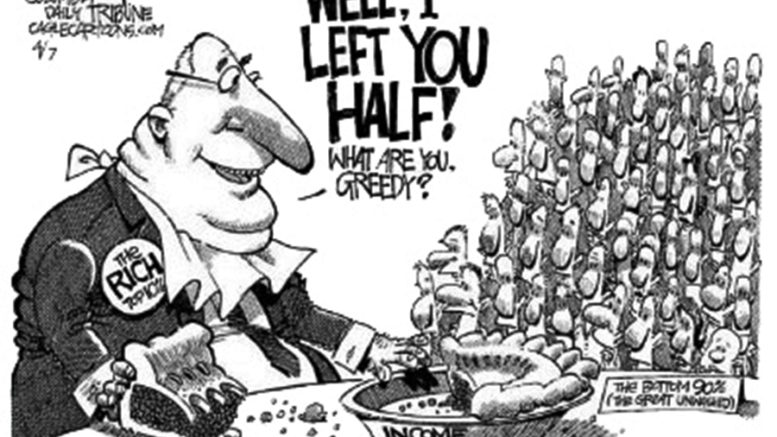

Well-off Australians are slashing their personal tax bills at a cost of billions of dollars a year to other taxpayers through the widening use of secretive family trusts.

But while trusts are flourishing, and the government is battling a big budget deficit, neither the Coalition nor Labor has tackled what critics describe as the “sacred ground” of tax minimisation.

Unpublished figures provided exclusively to Fairfax Media by the Australian Taxation Office reveal almost 643,000 discretionary trusts (most family trusts are this kind) in Australia in the 2014-15 financial year, the most recent year for which figures are available. That is almost twice the number of 20 years earlier, an increase that far outstrips population growth.

The increase is likely to have been sharper in the two years since 2015 as other popular tax minimisation options – superannuation and negative gearing in particular – come under heavy political pressure, and financial planners and accountants market trusts as an alternative.

Trusts come in different forms, including fixed and unit trusts. In total, there were 824,000 trusts in 2015 according to the tax office. Some are dedicated to charitable and community purposes, including caring for children and those with disabilities.

But discretionary trusts, which are used to manage investments including property and to run businesses of all sizes, are promoted for their preferential tax treatment.

Australian Bureau of Statistics data indicates that while discretionary trusts are often used for small and medium businesses, trust wealth is heavily skewed to the richest Australians. Almost 90 per cent of trust assets are held by the wealthiest 20 per cent of income earners.

While rarely mentioned in recent tax and revenue debates, discretionary trusts are a substantial part of the Australian economy. The unpublished tax office data shows they hold assets upwards of $600 billion, and generate profit of almost $80 billion.

The key to the popularity of discretionary trusts is the flexibility which allows high-income breadwinners to split trust income and distribute it to family members on low incomes and low tax rates – adult children at university for example. In the process, the high-income earner slashes their own tax liability.

The distribution of income can be varied each year. So, if a child leaves university and secures a well-paid job, their share can be transferred to a younger brother starting university, or a retired grandmother.

Exactly how much tax is paid nationwide on income from trusts is unclear. The opacity of trusts means information is limited. Where companies are required to put information about directors, shareholders and company finances (for larger firms) into the public domain, there is no equivalent for trusts.

Surprisingly, the tax office is unable to say how much trust beneficiaries pay in tax.

But Fairfax Media has established that at least one key federal agency estimates that tax paid by trust beneficiaries is about 25 per cent of profits – well below the marginal tax rates that those who control the trusts would otherwise be paying.

In a new analysis for Fairfax Media, University of NSW tax law expert Dale Boccabella has “conservatively” estimated the level of forgone tax revenue at $2 billion a year.

Be the first to comment on "The tax minimisation tool that nobody wants to talk about"