Contributed by Joe Montero and Ben Wilson

While delivering this year’s budget, Treasurer Josh Frydenberg put a lot of effort towards trying to convince Australia that everyone is going to be made better off.

It wasn’t hard to work out that this was spin, to counter public hostility, and at the same time, push through the government’s political and economic agenda.

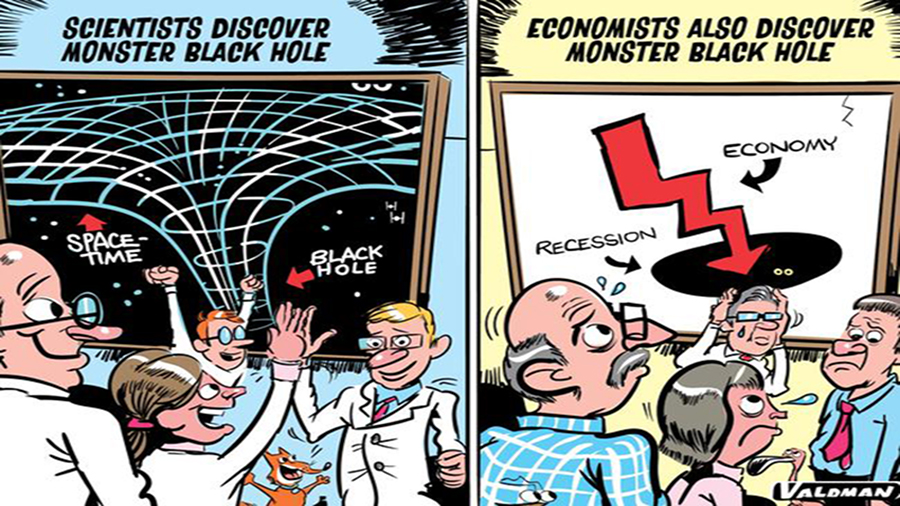

This is why there was a beat up over how well the economy is going and on track for a quick recovery from the Covid-19 shock. Pushed aside, is all the evidence that spells out an economy already in trouble and the headwinds on the horizon.

Australia was told everything’s sweet, except that there are some challenges and that these require everyone to make a contribution. The pain that will be imposed was glossed over.

Josh Frydenberg admitted that the government’s deficit will balloon out to $213.7 billion and the debt to $703 billion. Without any counter measures, the debt will hit $966 billion in 2023-24, which is 44 percent of Australia’s economic activity measured by the GDP.

Then he went on to say: “Our economic and fiscal strategy sets out the path to grow the economy, stabilise debt and then reduce it over time.” The deficit was projected fall to $66.9 billion in 2023-24.

See the irony in this? The Treasurer talked about stabilising the debt and the reducing it over time, while he admitted it is going to blow out. The reason? The Australian government is going to become even more dependent on borrowing form international financiers.

Sleight of hand like this provides political advantage to the government and leave the mess it creates to the future.

By far the most important part of the budget is the tax cut. At the top of the list of the other measures are the hiring credit scheme, the women to work subsidy, new depreciation allowances, and the manufacturing strategy.

The credit scheme offers employers $100 a week for every new job for those under 30, and $200 a week for those between 30 and 35. The problem is that the last thing struggling small businesses need is more debt.

Most are aren’t in the position to take advantage of the offer, and this means, the scheme will turn out to be subsidy for big businesses, which is under far less stress, and in a far better able to take on the debt. Even here, there is not enough in it to make a real impact.

Mention was made of the $240 million set aside to get women back into jobs. It is a paltry amount, given the scal of the problem.

What about the manufacturing strategy? This is centred around space, food, drink, and recycling and will attract $2.5 billion form the government over four years.

A real manufacturing strategy would focus on building high end technology industries, new energy generation and sustainability, relevant transportation and communications infrastructure, education and training, and research and development. This would need more investment than has been allocated. There is no real new manufacturing industry strategy.

These measures and the list of smaller ones are mainly cosmetic and will do little to create jobs and build the economy. The ywill contribute to making Australia a less fair place to live in.

They should also be considered in the context that the $70 billion for JobKeeper allocated in 2020 has been cut back to $30 billion in 20121. Those getting the extra pay have seen it cut $300 a fortnight, and the provision of $750 a fortnight for jobs of no more than 20 hours a week, signals a shift towards the generation of more part-time jobs, at the expense of full-time ones.

This is the real face of the 2020 budget.

Frydenberg promised the tax cut will “put more money into the pockets of 11 million hardworking Australians and their families”. The truth of it is that the bulk will go to those with incomes higher $100,000 a year.

Everyone else will get little. There is the $1000 one off payment for middle and low incomes. This does not change that fact that someone taking home $200,000 a year will get a 4.5 per cent tax cut, while someone taking home $45,000 will get 0.5.

This tax cut will cost $20 billion in lost revenue, and does anyone really expect that this won’t cost the majority, much more than the one off payment?

Business owners will be given more capacity to deduct the total cost of depreciable assets. In plain English, this is an incentive to invest in new technology and expansion. For most businesses, the objective is recovery.

In the circumstances, this is another subsidy to mainly benefit the best heeled and able to take the most advantage of operating on a large scale and replace more jobs with technology.

Better targeting assistance to smaller and struggling businesses would do much more for their recovery and the creation of jobs.

Despite all that is wrong with it, that most Australians have been left worse off, and the absence on any real plan for the recovery of the economy, some peak big business organisation leaders have been quick with their praise for the Morrison.

Chief Executive of the Council of Australia (BCA), Jennifer Westcott, called the budget measures “… incentive [that] will create new purchase orders and jobs by encouraging businesses to immediately expand, innovate, update technology and buy new equipment”.

Innes Wilcox, Westcott’s counterpart in the Australian Industry Group, said the budget would help to counteract the decline in GDP, which he blames on falling migration. Just how he connects these dots is uncertain.

The bottom line is that it is the members of these organisations are getting the lion’s share, irrespective of the interests of Australia and the economy. They have something to be happy about. But this does not make it right.

The elephant in the room is that the combination of the tax cuts, falling revenue going to the government, the increase in government borrowing to pay its way must be paid for in some way. In the absence of a major economic reversal, it is inevitable that the budget will be followed by a new austerity program to cut further government expenditure on public services.

In line with the government’s ideology, there will be a round of subsidised privatisation of services.

The cost of living will rise further, and the economy will continue to deteriorate, unless Australia can put a stop to it and comes up with s real plan.

I know you’re trying, but please, please, read “The Deficit Myth” by Professor Stephanie Kelton, and learn MMT, Modern Money Theory! The deficit does NOT matter, and we DON’T have to BORROW from overseas!