Contributed by Joe Montero

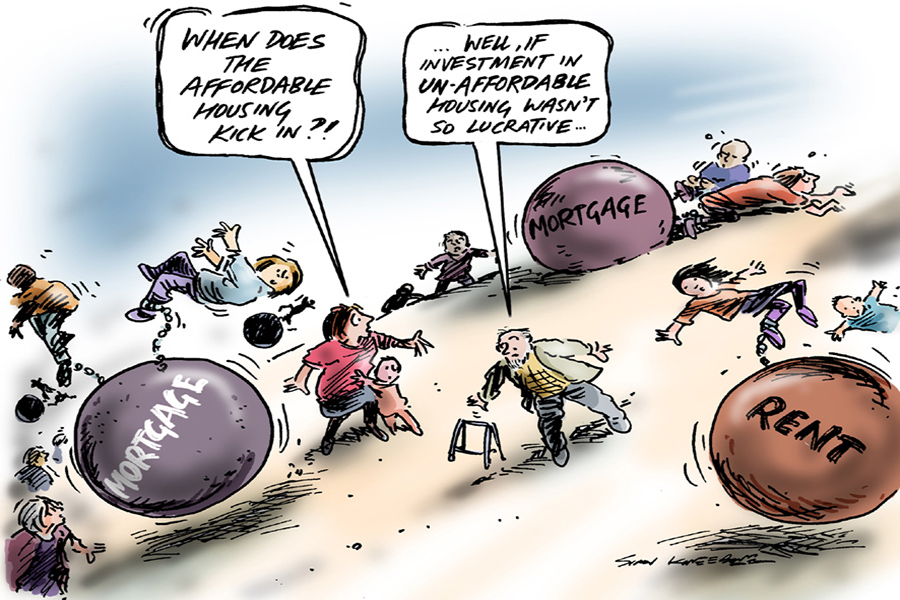

Housing affordability has emerged as a key election issue. So it should. Major part of Australia faces the startling reality that the cost of housing is the single biggest factor in their falling standard of living. It is the most important factor in the growing debt crisis.

All because a speculative property bubble has been allowed to fester for so long. This is what is at the heart of the deepening housing affordability crisis and is one of the great omissions of the election campaign. Neither of the major contenders have gone anywhere near addressing this.

By far the worst and most dishonest response has come out of Scott Morrison’s mouth. His scheme to allow home buyers to use their superannuation to buy into the property market ha been sold as a solution to the housing problem. It’s not. On the contrary, the effect will be to push property prices even higher, and this will flow onto rents. and the impact on the already serious debt crisis will hit the economy.

The Morrison plan for first home buyers pretends that this is a problem of supply. It’s not. Australia’s cities are filled with empty properties. Estimates have been as high as 69,000 for Melbourne in 2019. It similar story for Sydney, other cities, and regional centres. This is easily enough to create an artificial shortage and feed the bubble.

Negative gearing makes this possible. Owners of housing stock for potential rental are encouraged to leave homes empty because losses form rentals income are subsidized by the government. By leaving properties empty, potential landlords can make a bigger profit, because they can avoid the cost of maintenance. This is most starkly seen in inner city apartment blocks. It is also present in the suburbs and regional centres.

A further bonus to property owners is the rebates on Capital Gains Tax, which means that properties can be resold within a short time and feed the escalation of prices.

When you realise that the bulk of property buyers and not mums and dads but property-owning corporations with portfolios of hundreds and even thousands of properties, the scale of the problem is magnified.

The scheme to allow superannuation to be used to buy a home will benefit the property industry and harm most of those who face the housing affordability crisis.

Furthermore, the scheme is only allowed for first home buyers and there is a limit of 40 percent or $50,000. This might cover the deposit. But it adds crippling mortgage repayments with the added reality of a rising interest rate.

Labor has not taken the opportunity to take on negative gearing and lower the bar on capital gains. The major initiative here is a partial government subsidy on home purchases. The trouble with this is that most of the benefit will go to the better healed and the proposed outlay is far too small to have an impact on the overall cost of housing.

There is a consensus to allow people aged over 55, to use deposit up to $300,000 from the sale of a property, if they are downsizing, and letting age pensioners continue to enjoy their full pension for 2 years.

None of this provides an answer to the cause of the housing affordability crisis at best and is harmful at worst.

To really tackle the housing affordability crisis negative gearing must be wound down in stages. This can’t be done in one blow, as it would bring to big a shock to the housing market. A lower limit must be put on capital gains tax exceptions. Corporate ownership of housing stock must be curtailed. By compelling existing housing stock into the capital market, the extra supply will work to push down housing prices, and consequently, rents.

Most countries have a level of rent control. This means maximums are set on what landlords can charge. Australia has none. Most countries have laws that provide renters with considerable security. Australia has few.

Even these measures will not solve the whole problem. There is the fostered illusion that home ownership is the holy grail to success. It is an illusion because the burden of a large mortgage for a good part of one’s life is an obstacle from the ability to do other things in life.

A major incentive to get out of the rental market is to have long-term housing security. This is important. Home ownership may provide this. There also less brutal means to achieve this.

If Australia took to heart that to have a home is a basic human right for every Australian, something which the market can’t honour, Australia would realise that the only way to protect this right is a large-scale expansion of public and genuine community housing.

Other countries do this, and they share in having the world’s highest standards of living. Take Switzerland, where one in four homes is either owned by a cooperative or is public housing. This is in a country where one out of fifteen is a millionaire. In Sweden, 20 percent of all housing stock and half of rentals are public housing. These are but two examples showing what is possible.

It’s not even on the radar in Australia. Until it is and serious measures are put in place, the housing affordability crisis will persist and get worse.

Be the first to comment on "The housing affordability crisis being ignored in this election campaign"