Matthew Elmas wrote (the new Daily 4 May 2023) about the escalation of government subsidies handed to fossil fuel companies, as the government spruiked its claim that it will act far more decisively and go further on the reduction of carbon emission. It doesn’t add up. It’s time to put an end to it.

The value of subsidies and tax breaks for fossil fuel companies across Australia will reach a record $57.1billion in the next four years.

A new report by the Australia Institute found subsidies for fossil fuel giants in federal and state budgets will soon cost taxpayers 14 times more than the Disaster Ready Fund.

Although the Albanese government has stopped some of the Morrison government’s “more egregious” handouts, it has kept other ones, said Rod Campbell, a research director at the Australia Institute.

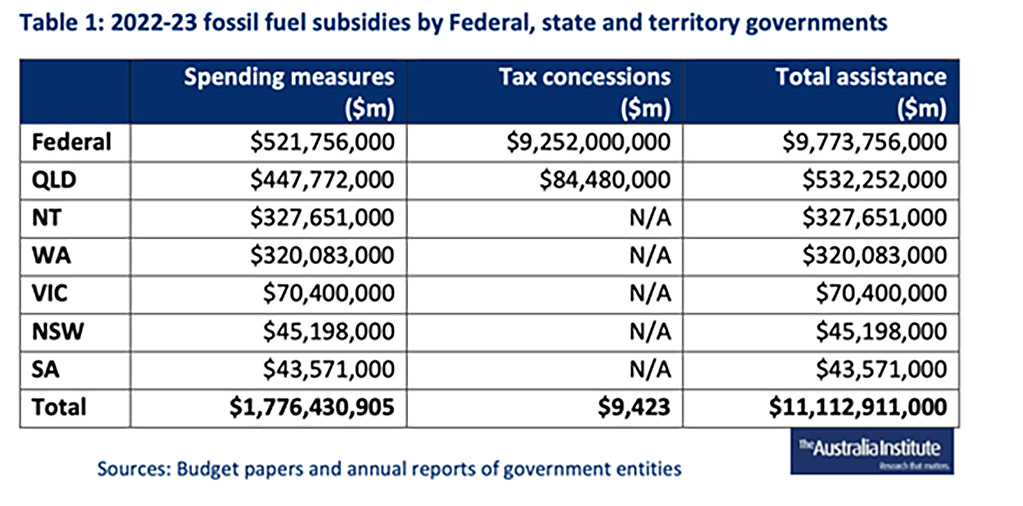

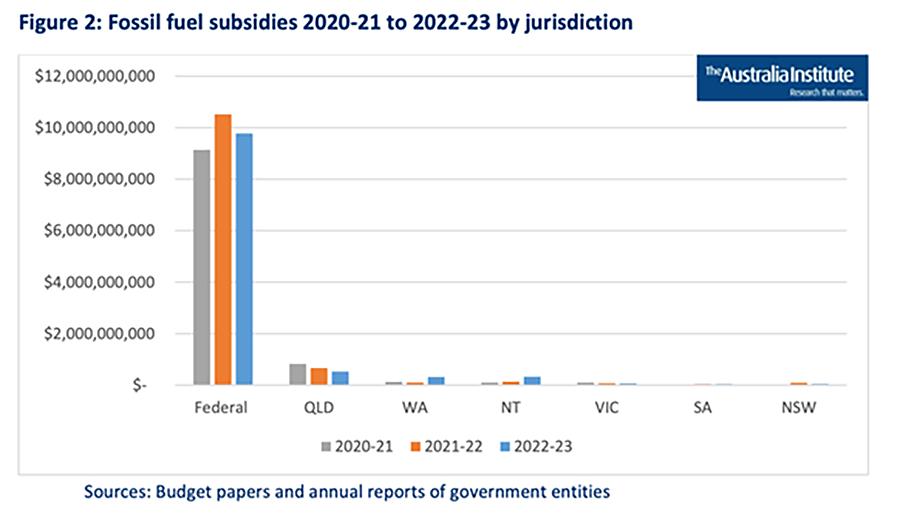

Total assistance to fossil fuel producers from governments has fallen from $11.6 billion in 2021-22 to $11.1 billion in 2022-23 – $9.7 billion of which will come from federal coffers.

From there, however, payments will rise to a record level in the next four years, driven by expectations of even higher fuel tax credit payments.

“A year on from the ‘climate election’ and we have fossil fuel subsidies breaking records in tandem with the rising global temperatures that put our economy at risk,” Mr Campbell said.

“Australian governments are now planning to spend more on exacerbating climate change through these subsidies than they are on getting ready for climate disasters.”

Prominent examples of federal fossil fuel handouts identified in the report include a $1.9 billion plan to support a petrochemical hub in Darwin and $141 million for carbon capture and storage.

Exemptions under the fuel tax excise for fossil fuel companies are tipped to generate $7.8 billion in tax credits for fossil fuel firms in 2022-23.

“Major gas projects like Middle Arm Sustainable Development Precinct and the Kurri Kurri Power Station are receiving huge handouts from the Commonwealth government,” Mr Campbell said.

“These subsidies provide a huge opportunity for governments that are looking to cut costs and take climate action. It’s time to stop funding climate change and start funding the response.”

Among state governments, Western Australia is providing the most support to fossil fuel companies, with $330 million earmarked in 2022-23 and a staggering $1.4 billion worth of longer-term budget pledges.

This includes investments in the state-owned Collie and Muji coal power stations, and $143 million in capital spending for gas power stations in Cockburn, Pinjar and Kwinana, the Australia Institute said.

The Northern Territory provides the second-most funding to fossil fuel companies of any state or territory, with $327 million committed in 2022-23 and longer-term pledges worth $3.59 billion.

This spending is partly made up of federal government partnerships that subsidise road and infrastructure development for the gas industry, alongside exploration initiatives, the report said.

The Australia Institute report concluded that the fuel tax credit regime, which will make up 70 per cent of all fossil fuel subsidies in 2022-23 budgets, is the main culprit of rising public support for fossil fuels.

However, other remnants of the Morrison government era, including hundreds of millions of dollars in funding for the controversial Kurri Kurri gas power station in New South Wales, are also sticking out.

“The expert advice is simple – we must phase out fossil fuels as quickly as possible if climate change is to stay below 2 degrees Celsius warming,” the institute’s report stated.

“With Labor governments across the mainland, and influence from the Greens and independents in most parliaments, governments now have an opportunity to walk the talk and stop subsidising fossil fuels.”

Be the first to comment on "Fossil fuels to reap $57.1 billion from Australian taxpayers"