Contributed from Victoria

The scandal engulfing consulting firm PricewaterhouseCoopers (PwC) Australia and its misuse of confidential government data to help clients avoid tax is escalating, and a week ago, senior management agreed to stand down those who were alleged to be directly involved in doing this. This appears to be way to for the company extricate itself from a sticky situation through putting the blame on these individuals. But it is unimaginable that such behaviour could take place without a conspiracy and approval. If not direct participation from the top.

We know that PwC has been advising a range of major corporations on how to avoid paying tax and could have misused information it was not entitled to have for leverage. Former tax expert at PwC, Peter Colins, was deregistered by the Tax Practitioners Board (TPB) for failing to act with integrity and for sharing confidential government briefings in January. He played a major role for a decade in securing government contracts. since then, Tom Seymour, the corporation’s CEO, has stepped down over the matter.

Photo by Brendon Thorne/Getty: CEO Tom Seymour stepped down over the scandal

After the scandal broke out, Treasury referred the matter to the police. It is obvious that the misuse of government data could not have happened without the involvement of people on the inside of the contrasting out department.

Last week, the close association between the NSW Police Commissioner Reece Matthews and PwC partner Mick Fuller was revealed during question time in the Senate.

Another revelation has been to the extent that the public service has become short staffed and dependent on outsourcing its work to outside contractors.

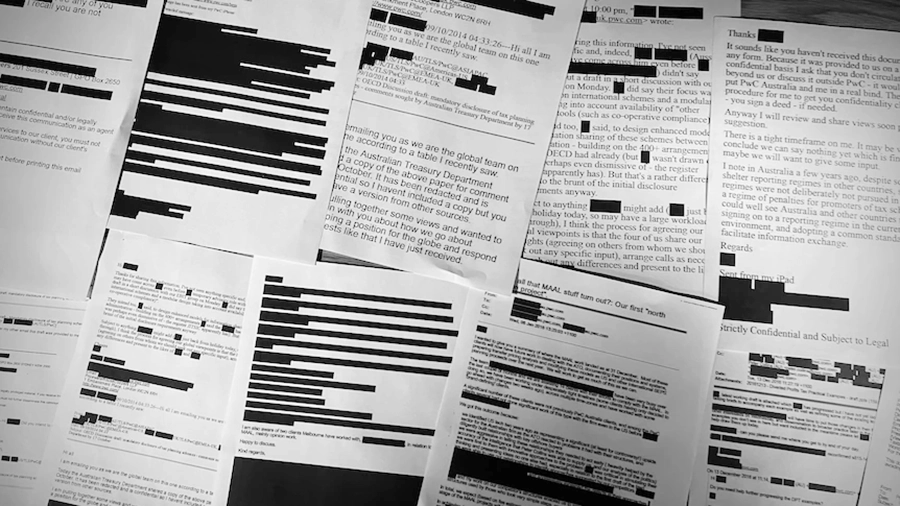

Photo by John Gunn/ABC: Damning emails from inside PwC released by a Senate committee

There is as smoking gun, which indicates an organised conspiracy to defraud the government and therefore the Australian public. A criminal investigation is justified.

But putting this in the hands of the AFP is problematic. PwC happens to have been contracted as its internal auditors, as well as carrying out some opaque roles in “management advisory services”, “strategic planning consultation services” or “unspecified services.”

We don’t know whether AFP personnel have been involved in misconduct, and to what extent in they have. The possibility is real, and prudence would suggest that it would be better to act on the side of caution. This is not the way the matter has unfolded.

Surely there is at least a conflict of interest here. There is potential for a whitewash, and for the government, incentive to contain the fallout, by eventually burying the issue. Especially when PwC is involved in the sensitive matter of advising a range of major corporations, on how to avoid paying tax.

Given the extent of the allegation of gross misconduct, why hasn’t PwC been stood down from operating as a government $537 million contracts (according to the Australian Financial Review), at least until the investigation has been completed?

This does not lead to confidence that the matter will be delt wit has it should be. This case is a clear warning of the risk of the contracting out of government responsibilities. There should be an investigation of government contracting out policy, to uncover how much harm it has caused. There should also be a phasing out of the habit, to remove this source of potential corruption. It would mean investing in the public service, to ensure it has the capacity to properly carry out its responsibilities.

Be the first to comment on "Conflict of interest means the AFP should not be investigating the PwC tax scandal"