Contributed by Joe Montero

The call by Brendan Coates, the economic policy director at the Grattan Institute, for concrete measures to address the housing crisis is timely and should be taken up. The cost of housing is the single biggest factor behind a lowering of living standards across Australia. There is no chance of a better tomorrow without overcoming this crisis.

Recent real estate price falls have been meagre and down from the stratosphere. They have done nothing to make life easier, and rising interest rates mean the cost of mortgages and rents are already on the rise.

Home ownership peaked at 71 percent in 1966 for 25 to 34-year-old age group. Between then and 2021 has plunged to just 40 percent. The poorer one is the less likelihood there is of entering the property market. Among the poorest 40 percent of this age group, home ownership is merely 28 percent. Down from the 57 a percent peak.

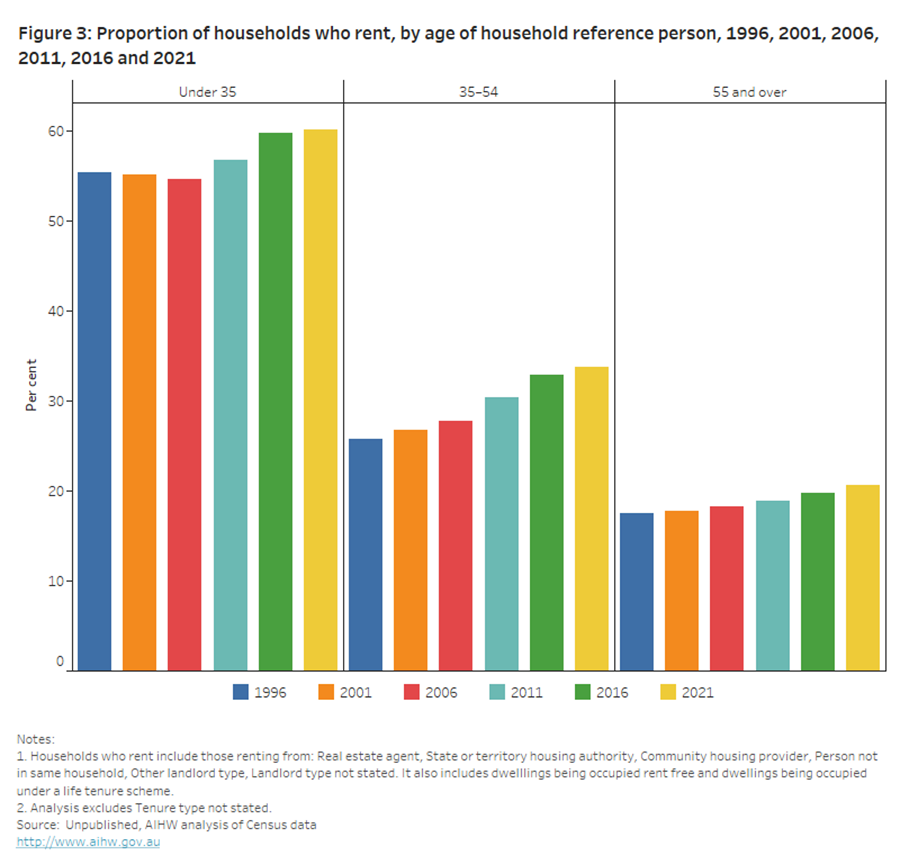

Unfortunately, official details on home ownership have not been published since 2016. But we can get a good idea by the rising proportion of Australians in all age groups into entering the rental market, as shown in the graph below.

Unaffordable rising housing costs cut into discretionary consumption as households pull in the reins. This flows on to the whole economy and depresses it.

Home ownership is falling, and this is pushing rents even higher. This demands alternatives to the goal of private home ownership.

Brendan Coates champions providing more high density living and an end to the quarter on an acre block, increasing commonwealth rent assistance to 40 percent, and the abolition of negative gearing and reduction of the capital gains tax discount.

He called out the myth that first-home buyers want the quarter acre block, saying that many “would prefer semi-detached dwellings or apartments in the inner to middle suburbs, rather than a house on the city fringe.”

Photo by Andy Brownbill/AAP: The increasing urban density in Australian cities shows a more away from the quarter acre block

An obvious remedy is to increase housing supply, and there has been growing talk about increasing social housing. While this is positive there is a trap in it, when used to boost the private sector. State government, which currently have the responsibility and lack the funds tend towards doing exactly this, and at the expense of public housing. There must be more responsibility at the national level.

Public and social housing must be separated. Although both provide alternative housing, they have different functions. Public housing is for those locked out of the housing market or choose not to take part in it, and don’t want to be burdened with management. Social housing is of two types. One is provision for special needs groups, and the other is cooperative housing for those who wish to manage their housing as a community, and housing semi-managed by an organisation.

All have their place. But the distinctions must be respected, and none should be played off against the others, or be pressured into entering the private rental market.

Increasing home private ownership is not the answer. Households and the economy don’t need an unaffordable mortgage burden. They need the capacity to spend on other things that provide a good life.

Government intervention through a big increase in the housing stock will provide alternative options, and this will lower real estate prices. Rents will be pulled in the same direction.

Last month, the federal minister for housing and homelessness, Julie Collins, made a statement where she promised to “…address the complex challenges facing our housing system – from homelessness to increasing supply of social and affordable housing.”

Hopefully, this promise will be honoured.

Coates voiced his support for more government funding of housing. He also called for a strengthening of the building code to ensure builders return a greater proportion of windfalls from land rezoning to the community. This means helping to provide for alternative non-market housing stock.

Although increasing the public supply of housing is the main game, this could be further strengthened through the removal of incentives that have been contributing to the speculative bubble. Negative gearing and the capital gains tax discount can be phased out.

There is also a good argument to increase population density, favouring apartment blocks to the quarter acre block. This would provide benefits through the lowering the costs of construction and the provision of infrastructure and services. It would help conserve the use of water and reduce energy consumption. This is good for the environment. Higher density would cut the cost of and increase access to transport systems, health, waste disposal, and other services, which, ultimately adds up to lowering the cost of living and improving lifestyles.

A bonus is that this would provide an opportunity to strengthen communities and build new ones, and this is important too.

One final note. Pressure on rents can be reduced by bringing in rent control by setting ceilings on what landlords can charge. There is no good reason they shouldn’t make their own contribution for the wellbeing of the community.

Be the first to comment on "Creating housing affordability means proper funding of housing alternatives"