Contributed by Joe Montero

As the reality of the biggest economic and job crisis experienced since the Great Depression hits home, and the failure of economic policy to address the underlying problems over decades becomes increasingly obvious, interest in alternative approaches to economic policy has grown.

Decades of failure to address the already existing climate crisis has contributed a new dimension to this interest in alternatives. To make a life for themselves, members of any society must interact with nature, and how we do this is critical. Climate and the economy are inseparably bound together.

Another factor is that members of society have become increasingly disengaged from the political processes and institutions, which they see as failing to solve the critical problems and denying the normal person a true voice.

Finally, the arrival of Covid-19 has changed our lives and put into starker relief the failures of the status quo.

This is leading to a polarisation of opinion. On one side there is a retreat into what is believed as the good old days, of simplicity, old values small government, and the promotion of the unrestricted market as the solver of all problems.

At the other pole, is support for change of different kind, where there is more equality, participation and bottom up democracy, and economic sustainability.

One trend within the second pole is that the concept of the Green New Deal is getting some traction. Whether this is a real alternative depends on the detail and not the label.

The most basic interpretation of the Green New Deal is that it is founded on a recognition that the public sector must be proactive creating jobs, and to do so, in a manner that rebuilds the economy sustainably and delivers fairness across society.

These are worthwhile ambitions. The real argument is, on the methods used to achieve these ambitions.

Most supporters of a Green New Deal put their hopes on a return to Keynesian economics. This holds that the basic economic problem is that investment lags effective demand, and this requires government intervention as consumer, investor, and creator of jobs, to close the gap between investment and effective demand.

Basic to Keynesian economics is the investment lag problem, and that the foundations and nature of the capitalist economic system are sound and does not require change.

The poster for Keynesianism is the American New Deal during the Great Depression. It is credited with putting people to work through major public projects and fixing the depression. There is absolutely no doubt that it did have an effect. It is also exaggerated through the lens of distance, however. The New Deal eased the suffering. It did not end the depression, which continued until World War Two.

Although there are some important differences between the Great Depression and now, in some respects we are repeating history, and one of the lessons of the past is that the Keynesian approach is not enough.

Nevertheless, there has been a resurgence of Keynesianism. An offshoot of this is something called Modern Monetary Theory or MMT. Its adherents say this is the answer to neoliberalism, and the theory has been linked to the Green New Deal.

MMT is not so new. The title was coined by Australian economist Bill Michell, and championed by others, such as Warren Mosler, and L. Randall Wray. But its real foundation is in Abba P. Lerner’s Functional Finance theory, published in the mid 1940’s.

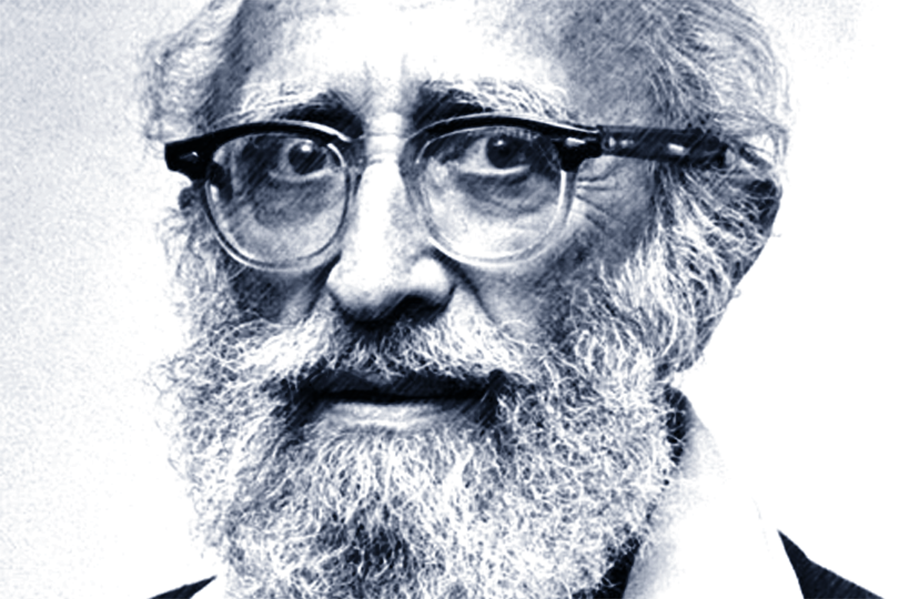

Abba P. Lerner in 1944

Lerner was a dedicated Keynesian with a twist. He was associate of Keynes’s disciple Joan Robinson, with whom he had much in common.

Although firmly rooted in concept of lagging investment, relative to effective demand, Lerner mixed this with a tilt towards monetarism and welfare economics.

The monetarist side raises the control over money supply as a principal tool for economic management. He argued that during an economic downswing, increasing the money supply available to government, enables it to add stimulus, and that taxation can be used to withdraw money from circulation when there is an excess.

Lerner argued that the barrier to this was the fixed gold standard because it prevented the side effects of excess money being adjusted by shifting exchange rates.

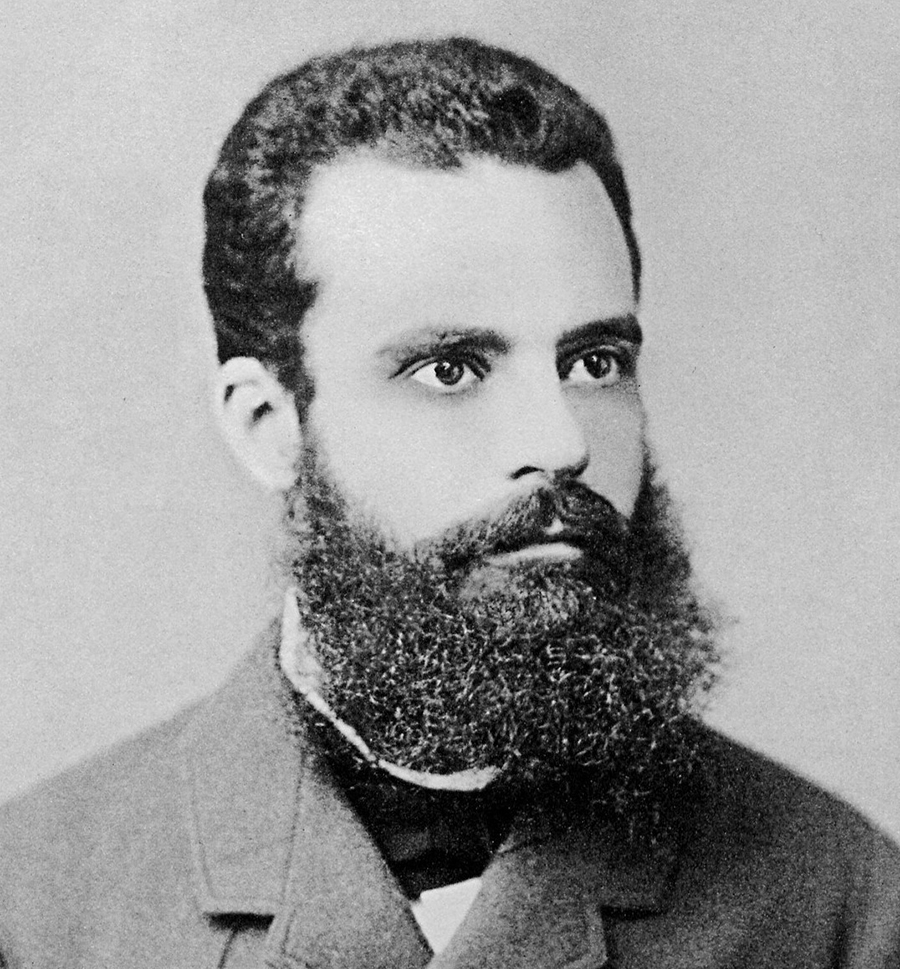

Welfare economics is based on the theory of nineteenth century economist, engineer, and social scientist Wilfredo Pareto, who argued that no one can be made better off without someone else being made worse off. Thus, progress can only be measured if at least one person is made better off without anyone else being made worse off. This is the Pareto Principle

Wilfredo Pareto C1870’s

The problem here is that this is impossible. The lifting of any part of society means a redistribution of income and wealth, and this would violate the Pareto principle.

This is a key pillar on which MMT falls short.

Another pillar on which it falls short, is the Lerner argument that without the gold standard currencies are sovereign or “fiat,” and this means, the government freedom to create money and no such thing as a deficit problem.

Although the gold standard no longer exists, it has been replaced by the US dollar. It has the same characteristics as gold. Secondly, although some fluctuation in exchange rates is “permitted” under the current exchange rate regime, this is only within defined parameters. What we have is a partially floating exchange rate regime, backed by global financial institutions, which exercise considerable control over the money supply and its flows. Currency sovereignty doesn’t really exist.

There is more. The quantity of money and the rate at which it circulates is no longer mainly under the control of government. Since the arrival of the computer revolution, much of this control has been passed onto private institutions.

International and national payments are mainly made through the push of a button and not by transferring cash. These operations change accounts just as surely as handing over notes and coins. The difference is, this form of money creation in the form of an IOU, is what we call debt, and its explosion, has changed the relationship between debt and the economy.

In this situation, government creation of money means the creation of public debt. Some adherents of MMT suggest this is no problem. They are wrong. There is a problem. It lies in who is going to pay for this debt?

The standard answer is that subsequent growth and the extra tax revenue this generates will take care of it.

To a point. But the scale of what is required exceeds this by a long way. This is not recognised because the theory assumes that the economy is fundamentally sound, with plenty of capacity, and only held back by the brake of insufficient demand.

The theory fails to see that the problem creates by these imbalances are too big to be resolved so easily.

This means that the burden will fall on normal wage earners who pay most of the taxes, which in turn, subtracts form the gain from the stimulus.

Add that the shifting of income and wealth upwards during a time of economic downturn, is one of the main imbalances. It rises out of structure and social relations within the existing economy.

MMT ignores this. To otherwise would be to recognise the need to do something about it, and this would violate the Pareto Principle.

The theory does not understand the real nature of money, as an equivalent of the values of what we consume, in addition to being a medium of exchange. Money is treated as something outside the economy, rather than being internal to it, and lacks an appreciating that changes in its quantity and circulation, impose ripple effects through every part of the economy.

In the end, MMT fails as an alternative.

But this does not mean that key proposals of the theory’s supporters should not be taken up.

Increasing public expenditure is needed, so long as it is targeted to creating real jobs in industries needed and promotes sustainability. The incapacity of private investment to meet this need is real, and the responsibility falls on the public sector.

A jobs guarantee for all is the best way to back stimulus to create jobs. It must tackle both unemployment and underemployment as a national priority and as part of a comprehensive plan, featuring job creation programs.

Without this, there is not likely to be much progress. It would depend on a market adjustment, and the failure of the market to do this, is a big part of the problem in the first place.

An important supplement is putting into place the guarantee of a sufficient income for everyone. This would allow all to participate in the economy and society, and ensures that jobs creation does not become a vehicle for exploitation and the generation of substandard work.

The inclusion of much more affordable housing and free or low cost education, health services and other public services would be a great help.

These measures, brought about through the redistribution of income and wealth, are the foundation for a real alternative.

In addition to lifting most of the population, this is the way to encourage support and involvement. The best of plans need this, to achieve their potential. People must feel that they are fairly rewarded for their effort and have a voice.

Be the first to comment on "A critical view of Modern Monetary Theory"