Contributed by Joe Montero

The amazing ability of our politicians, whether we’re talking about the government or opposition, to admit that the vast majority of Australians are becoming progressively worse off, and that this has its genesis in fundamental structural weaknesses in the economy, speaks volumes.

One doesn’t want to continually broadcast gloom. It’s much better to look forward towards what we can achieve together as a community. But an ongoing failure of political leadership has pulled in the opposite direction, and by doing this, create the necessity to continually point out the failure and search for new answers.

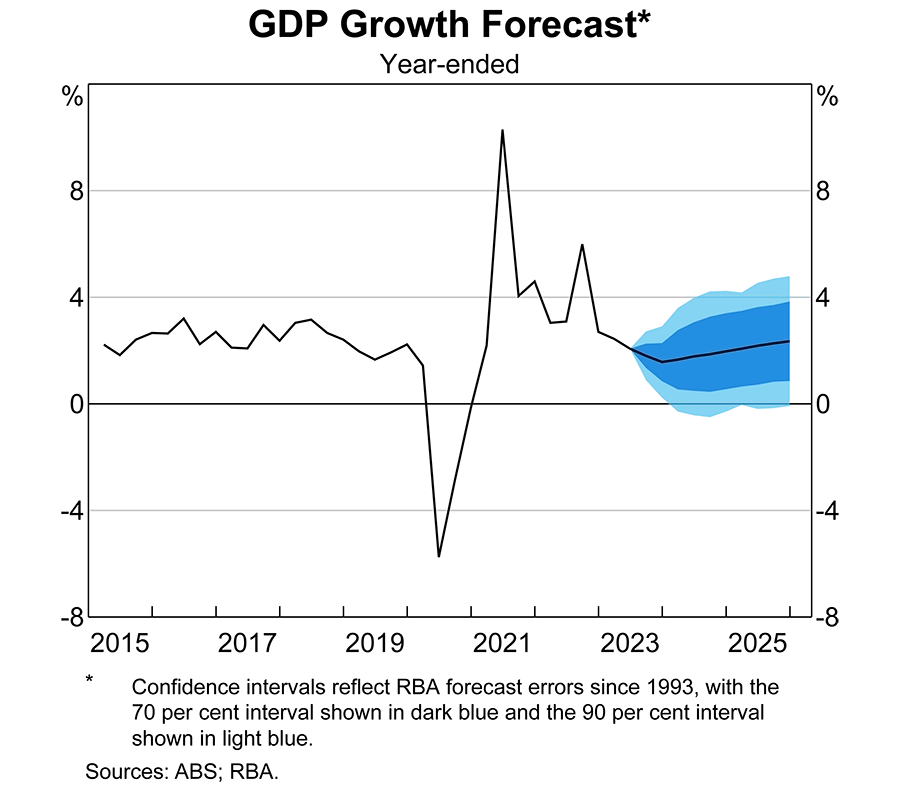

Last week’s Gross Domestic Product (GDP) figures provide a surface picture of some growth. The political elite seize on this to tell us how well everything is going. Even when on a quarter-by-quarter basis if dropped from 2.1 percent to 1.5 percent. What they leave out is that this apparent growth is accounted for by the rising cost of housing, lower real wages, and especially the relative rise of the financial economy versus the real economy.

The graph below indicates that the past Covid Shock has stabilised and the pre-Covid sluggish economic trajectory has reasserted itself, if you take away the largely speculative confidence forecast.

For most of Australia, the damage comes from the ongoing fall in real wages, the rising cost of life’s necessities, and the continuing upward spiral of mortgages and rents. This doesn’t only answer the fiction of a healthy economy. It’ a pointer to the reality of growing inequality.

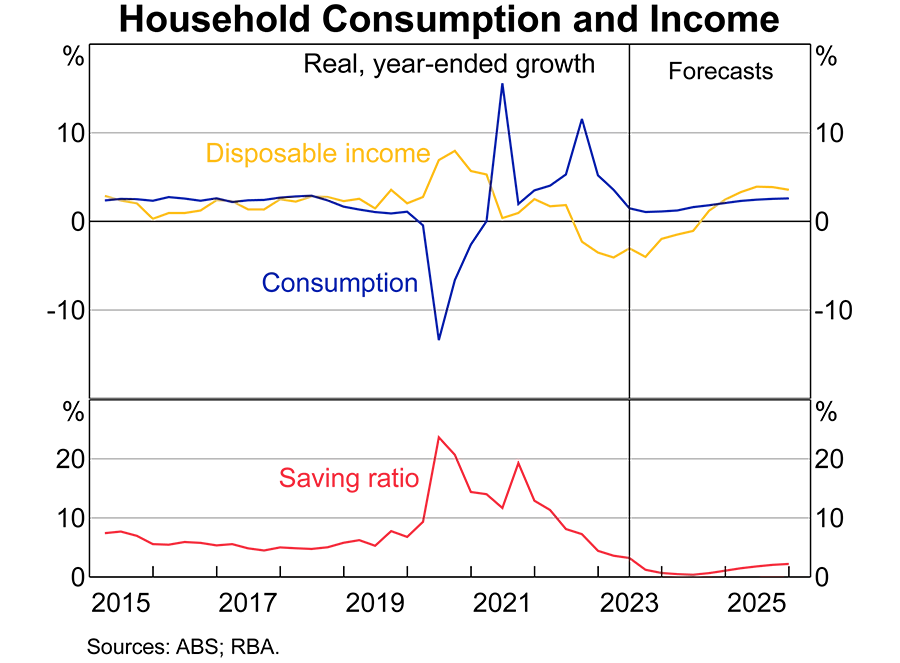

Taking this little further. NSW and Victoria did best in GDP terms. The Northern Territory experienced a fall in GDP because of the fall in the export prices of oil and gas. Recorded nominal income growth across the nation was just 0.9 percent. The cost of living went up by 5.4 percent and disposable income fell 5.1 percent in the last quarter. This proves that real incomes went backwards.

The graph below shows a dip in household income, consumption, and the savings ration (between consumption and saving). Once again, the confidence forecast doesn’t provide a factual picture.

What is going wrong then? The answer’s not too hard to find for those who want to know. Australia no longer makes things as was once the case. The economy relies far too much on investment on financial assets, meaning the illusion of growth through rising debt. Why? Because the market has decreed that the return on manufacturing is too low compared to investment in debt and speculative bubbles.

The exception has been the extraction and export of fossil fuels and mineral ores for high prices. This now seems to be coming to an end, a reality that will plunge Australia into greater economic difficulty.

Those few with the capacity to invest big time in debt, speculation, fossil fuels and mineral extraction have been pocketing huge returns. Big retailers have been doing well by using inflation to bump up prices even higher. Major employers shave been able to use the shortage of real jobs to create insecure and lower paid work as a major source of their profit.

This is the real nature of the so-called economic growth of recent times. The last quarter was no exception. But this type of growth is parasitic. It eats away at society at casts a shadow over the future. This isa bout a redistribution of the nation’s wealth up wards. A few proper from this. Everyone else and the economy gets to pay the cost. ultimately though, the paradox is that it threatens the few as well. The present course is unsustainable.

Any answer to this revolves around recognising that an unbridled market is the problem. In conditions where the return from making things and providing the services that gets these commodities to us is declining, the market will decree a shift to other sources of profit. It follows that a solution must involve some restriction of this market.

The failure to recognise this and take appropriate action is a political problem. Australia’s political system is geared towards service to the top end. When its immediate interests lie in continuing on the same road, their own survival becomes the priority for the political elite, who depend on the patronage of the top end.

Knowing the nature of the problem brings the possibility od recognising the solution lies in the rise of a social economy. This is an economy with strong public and community sectors.

Australia should be talking about an economy that is for people, that shares the gains fairly, and looks towards real growth that is sustainable into the future. It’s the people of Australia who are the real engine for progress. The main role of political leadership should be to help unleash this engine.

Be the first to comment on "Australia’s economy still crying out for a change in direction"