Contributed by Joe Montero

On Friday, two of the most powerful central bankers in the world, delivered back-to-back warnings against governments removing existing controls over the financial industry.

At first glance, it may seem odd that central bankers might stand up for regulation of the industry. It makes sense though. From their point of view, they see the potential risks to the whole financial sector. Regulators are less concerned with the gains or losses made by an individual business than they are with how the whole sector is fairing. What is good for one is not necessarily good for the other.

Now that the global and many national markets are less certain and riskier, the incentive is to overcome this through sufficient regulation and the imposition of barriers to mavericks, who might upset the apple cart. By this means the risk of financial loss is lessened across the financial system.

During the financial crisis of 2007, governments used regulators to limit the damage, by covering for the banks (increasing liquidity) and other financial institutions. This soon became known as corporate welfare. There is a clear incentive to keep this line of assistance open.

This is why the world’s two most powerful central bankers delivered back-to- back warnings last Friday, against dismantling tough post-crisis financial rules that the Trump administration blames for stifling U.S. growth.

European Central Bank President Mario Draghi, speaking at the Federal Reserve’s annual retreat in Jackson Hole, Wyoming, pointed out that this is not the time to loosen regulation given that central banks are still supporting their economies with accommodative monetary policies.

That warning followed earlier remarks by US Federal Reserve Chair Janet Yellen, who offered a broad defense of the steps taken since the 2008 financial-market meltdown and urged that any rollback of post-crisis rules be “modest.”

The combined effect was “a subtle shot across the bow of those who seek deregulation,” said Michael Gapen, chief U.S. economist at Barclays Capital Inc. in New York.

There is also a political factor. Banks are unpopular just about everywhere. They are seen as grasping institutions and are blamed for many of the existing economic problems. The banks have a major public relations problem.

There are those who have pushed for a more expansionary monetary policy and the imposition of less austerity on society. This approach is being pushed by the International Monetary Fund (IMF) and the World Economic Forum, and central banks are seen, as playing the role of expansionary stimulators and regulators as preventers of the type of extreme behavior that contributed to the 2007 meltdown.

Overriding, is a growing expectation that there is trouble ahead. HSBC, Citigroup and Morgan Stanley, three of the biggest banks in the world are all showing they are worried. They are not the only ones. because the relationship between stocks bonds and commodities is being extensively fueled by speculative prices that are increasingly out of sync with the functioning of the real economy.

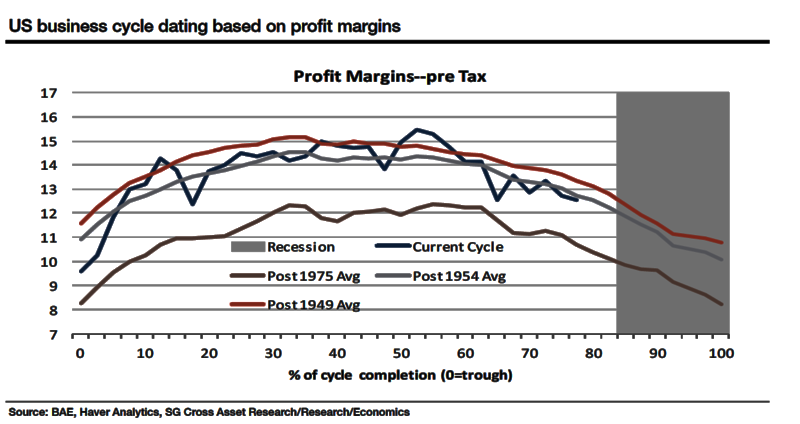

The graph below shows a repeating cyclical pattern of a squeeze in pre-tax profit margins in the U.S. business cycle. A similar story applies to other countries. What this suggests is that investment seeking a greater return is going to be less stable and therefore the chances of economic shocks will be greater, so long as the downward dip in the cycle continues.

Be the first to comment on "Regulators are starting to stand against further deregulation of finance"