Contributed by Joe Montero

Forecasts for the Australian economy from the Reserve Bank of Australia have not been exactly optimistic, given the statistics coming from the Australian Bureau of Statistics (ABS) and other forecasting institutions.

All the major indicators are pointing south. The only dispute is over how far they have fallen and the degree of impact in the time ahead.

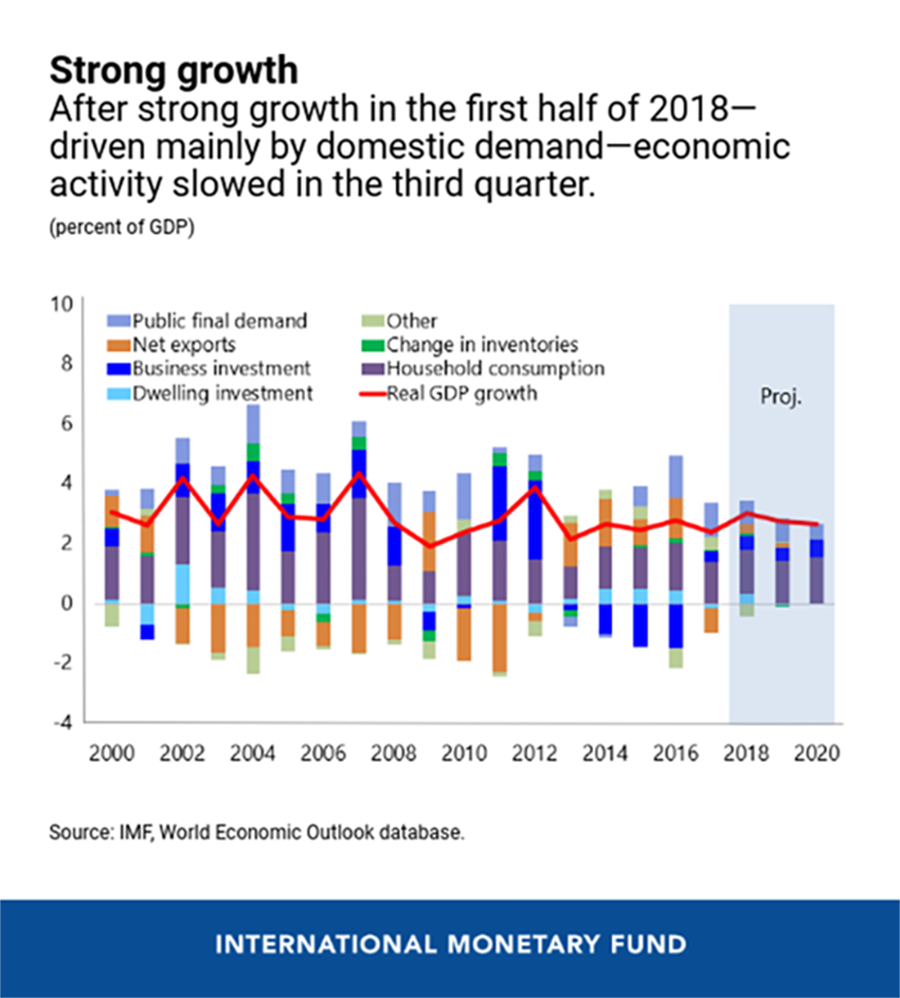

In comes the International Monetary Fund (IMF), the Washington based international financial regulator. It’s view is more pessimistic. The IMF has called on the government to get on with some stimulus spending and by implication, put less focus on the budget surplus.

Prime Minister Scott Morrison has rejected this.

The numbers have been churned out time and time again. They will not be repeated here. The intention is to glimpse at the reasons for the trends, point out some of the fallacies, and suggest away to work towards a solution.

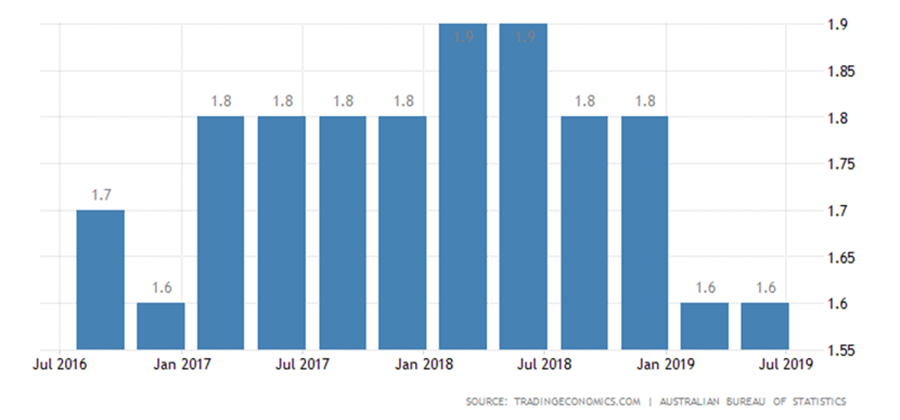

Interest rates, inflation, trade, wages and economic growth figure highly in the statistical trends. Aside from the pressure on inflation, the others are obviously moving together in the same direction, and this is downward.

Let’s begin at interest rates. It’s no secret that the rate in Australia is very low and going lower. Politicians will often sell this as a good thing. After all, the lower the rate, the cheaper it is to borrow. This is particularly useful to home buyers.

But this narrow view leaves out what drives the falling rate and the broader consequences. The interest rated does not move up or down arbitrarily at the will of a politician or functionary. Short-term artificial shifts can be imposed. But the forces operating in the economy will re-assert themselves before long.

The interest rate is determined by the quantity of goods and services that a given sum of it can be exchanged for. If this quantity falls, the interest rate goes down. If it rises, it goes up. Government intervention changes this relationship for a short time. Holding it lower encourages spending. This is what is happening in Australia right now.

Looking at it from another angle. The movement in the interest rate acts in reverse to the inflation rate. Inflation can best be explained through a simple example.

If one day a pie is exchanged for $3 and the next day it takes $5 to exchange for the same pie, we can see that it now more money to exchange for the same quantity than had been the case the day before. The measure of this difference is the inflation rate. In reel life, of course, this does not apply to one example. It applies to a whole economy.

This opposite movement exists because the market will react to the changed relationship between money, and its capacity to be exchanged is affected through the price mechanism.

An increase of money in circulation without a corresponding increase of goods and services in circulation, will cause prices to go up. This is why interest rates can be used as levers to exercise limited control of the amount of money in circulation and influence the inflation rate.

This is no problem in an economy that soon restores the balance between the money supply and the real economy, that enjoys sufficient economic growth. This is not happening today, and therein lies the problem.

There is a good reason for this. A large part of the declared economic growth involves financial transactions. While they are a necessary part of the economy, as long as they are servicing the needs of this economy.

Financial transactions might be profitable to those making them, but they are not real economic growth. They just shift ownership of existing assets. They do not create new ones.

This is not a problem as long as on an economy wide basis, the new real economic is greater than the financial transactions. This is not being achieved.

Other parts of the economy are in decline, and this has the following effects. The money supply relative to economic activity increases. In the absence of a big enough rise in the real economy, the RBA keeps the interest rate as low as possible to increase society’s spending, in the hope that this will be enough to stimulate the real growth.

On the other hand, banks and the other financial institutions, aside from dividends and trading in the share market, make their profits by lending out money and pocketing the interest they get back. A low interest rate will cut into this. There is a contradiction. The higher the rate, the higher the profit. At the same time, putting money into circulation pressures the interest rate downward. This is countered by lending out even more money, and in the current circumstances, this has given rise to the debt bubble.

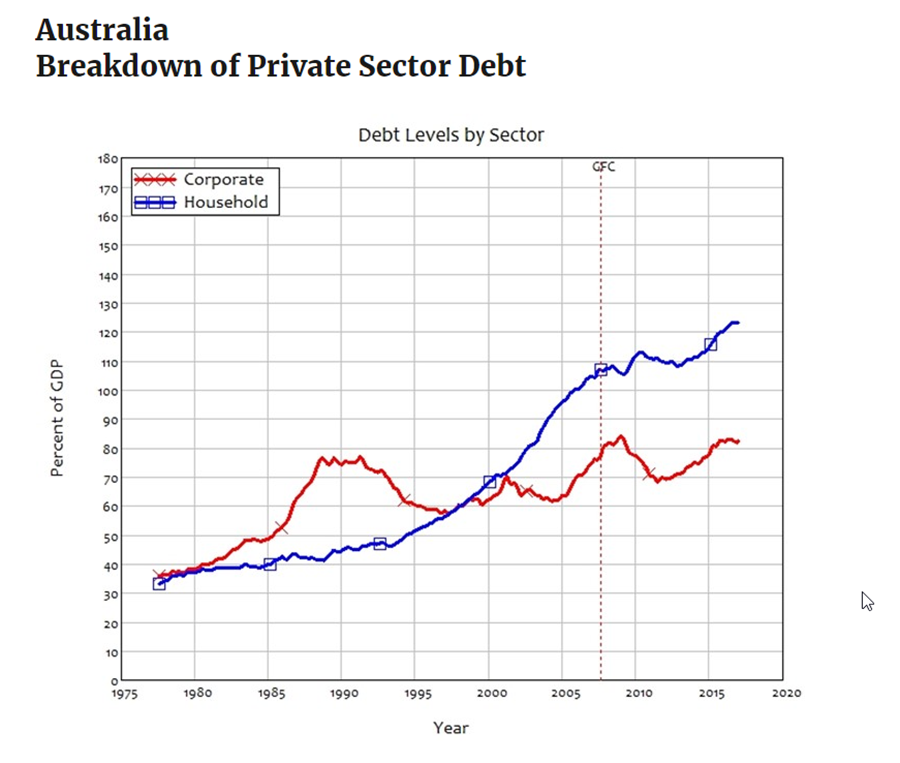

The ongoing debt bubble exists because the banks and the other financial institutions dominate the economy, and this has created the situation where it chugs along on the back of ever-growing debt.

We felt the impact of the runaway train during the 2007 Global Financial Crisis. This contradiction was eased by handing over tax dollars to these banks and other financial institutions and increased government expenditure to boost demand and soak up some of the slack.

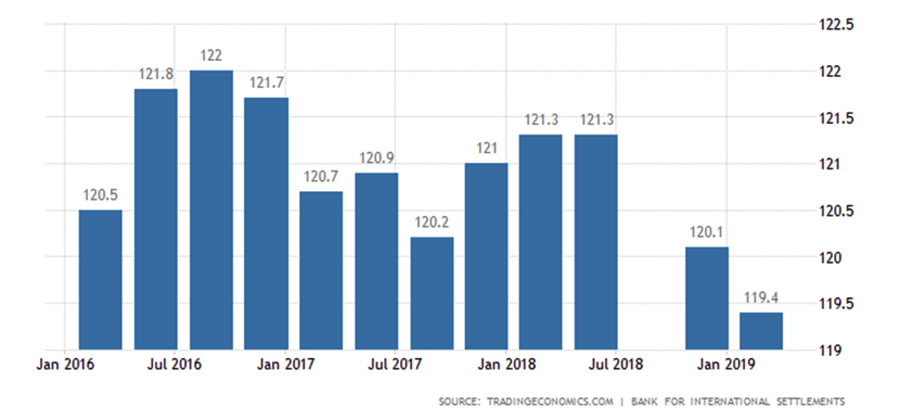

This is a global problem. But Australia is doing worse than just about any other developed country, because the extent of household debt and dependency of the economy on the debt bubble is greater. This is unsustainable, and Australia is vulnerable to any sudden economic shock.

The US-China trade war is already having some impact. imagine what might happen if this escalates.

A low interest rate will not fix this. The experts at the IMF know it, and push for a new stimulus response from the Australian government. The idea is that government spending can be an engine for the growth of the real economy.

Another consequence of the state of the economy is that the market induces a turn towards profit through increasing the exploitation of labour as a resource. This means cutting the wages share, introducing more flexibility through the casualisation of labour, and downgrading established working conditions to lower other costs of operating a business. This might boost the bottom line for employers. But across the economy, the capacity to spend and economic growth are eroded. It is ultimately self-defeating.

This contradiction arises from the conflict between the short-term view of the individual employer and the collective interest of society, including the collective interests of all employers.

Although it is the better option, the stimulus approach is not likely to achieve more than a limited result. The problem is too big. The amount of stimulus needed to turn the situation around is huge. Even more importantly, the problem is rooted in the structure of the economy.

The Organisation for Economic Cooperation and Development (OECD) said in 2015, that the deregulation of finance over the past 30 years has probably stunted, not boosted, economic growth.

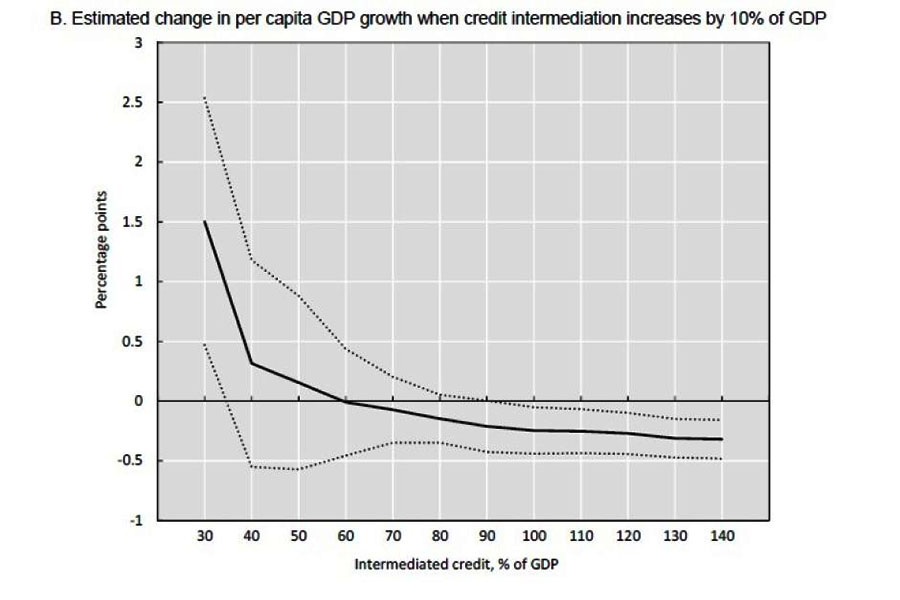

The report finds that an expansion in lending boosts economies up to a point, but when loans exceed around 60 per cent of gross domestic product (a key measure of an economy’s output) then further lending actually dents long-term growth.

A solution depends on breaking the dominance of finance over the economy, which has arisen out of a long period of concentration of ownership and the rise of monopoly power than behaves as a cartel. The Banks Royal commission made this very clear.

A solution depends on breaking this cartel by outlawing certain practices, regulation of others, and above all, establishing a public banking system, big to enact a policy for channeling investment to where it is needed to ensure a proper and balanced growth of the economy and to ensure finance meets the needs of society.

In effect, we are talking here about building a social economy, where the interests of society prevail when these and private interests come into conflict.

Scott Morrison will not choose even the soft IMF option, because he and his government are so closely bound with the dominant economic interests, and an ideological obsession with the unregulated market at all costs.

The IMF is less dogmatic, less tied to such a narrow base of interests, and therefore able to be more flexible in its approach. But not so flexible that it would challenge monopoly power and cartels.

Unless this challenge is met, the winds of economic downturn will sooner or later coalesce into a storm that will threaten to bring it all down.

Be the first to comment on "The real question is why Australia’s economic indicators are pointing downwards"