Contributed by Joe Montero

The first part of this series of articles noted that the current economic downturn is the result of the economic structure of the economy and aggravated by the Coronavirus outbreak. Evidence of this is that the downward trajectory has been around for some time.

The most important cause has been the change in the mix between the proportions of labour on the one hand, and technology and systems used (simplified by the use of the term capital in this context).

Capital intensification has led to a decline in the per unit quantity of new value created, and this has had a multiplier effect through the economy. More on this later.

Measured growth, with the exception of mining exports, has been largely in the form of the transfer of money, and much less on an expansion the real economy. This is turn, has fed a credit bubble an much more.

Other factors have led to this, through causing problems in the engine driving the economy, restricting the market and causing a problem of relative over supply. These serious issues that are not being tackled.

More and more people are calling for a much bigger stimulus response, as the means to create jobs and turn the economy around. This is put forward as the alternative to neoliberalism, the doctrine that championing an no restriction of the market, as little government involvement as possible, and budget surpluses.

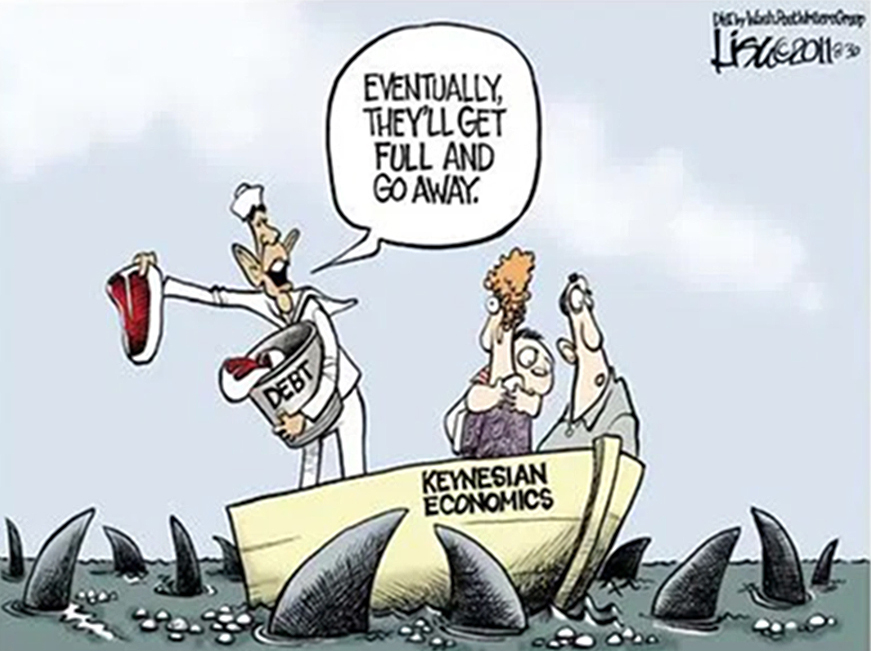

Stimulus implies less reliance on the market, more government involvement in the economy, and holds that budget deficits are not necessarily a bad thing. It sounds plausible. If only life was so simple. Stimulus spending on its own does not offer a solution.

In the first place, who is going to pay for it? Is it going to be the wage based taxpayer. If it is, the goal of spending to increase consumption will be compromised. Giving with one hand and taking away with the other will achieve nothing.

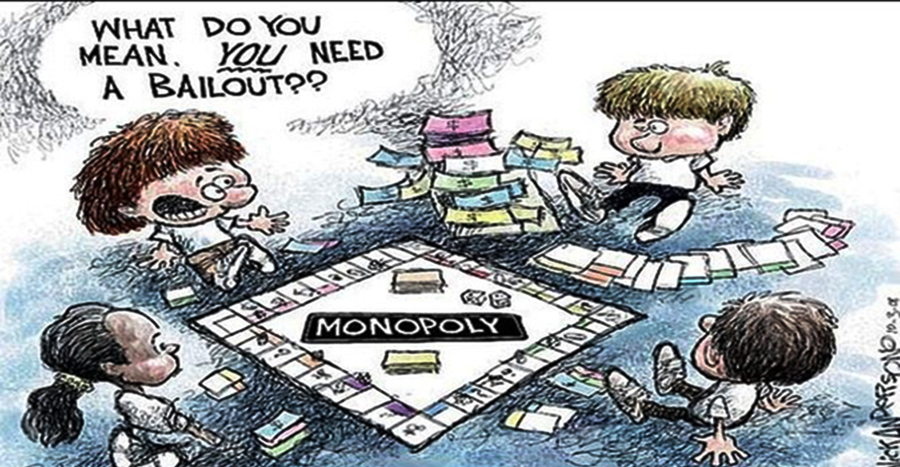

Corporate bailouts can at best only provide short-term solutions, and make the situation even worse in the future, by feeding waht gave rise to the problem in the first place.

An alternative is to impose more tax on the wealthy, and shut off the corporate tax avoidance industry. This could work. The down side is, that it may well lead to an investor strike. There must be a strategy to minimise this threat, if this approach is going to work.

Then again, not all investment is good. Discouraging speculative bubbles and ultimately dead end reliance on fossil fuels, are two examples. The need is a direction of investment into a productive economy, centred around the rebuilding of manufacturing on a modern and sustainable foundation. Government monetary and fiscal policy should serve this.

There are those who suggest that the government could borrow as much as it needs. This forgets that borrowing creates a bill to be paid a little way down the track.

If the economy does not create enough new value to generate sufficient revenues in the near future, there will be trouble. Just lifting the lid on government spending will not work.

A worthwhile stimulus package must also answer what is going to be stimulated and how it is going to be paid for.

Even if these questions are answered, it will do little to overcome the basic problem that is driving the downturn. This is the proportional shift In the proportional use of labour on the one hand and capital on the other.

This is how it works. The introduction of new capital is attractive to the investor because the cost can be spread over a growing volume of output, meaning, that the amount laid out for each unit is less.

The cost of labour is different. Everything else being equal, the cost remains the same. It is part of the reason why there is a transfer. In real life everything else is not equal.

During an economic downturn the bargaining power of workers is weakened, and this provides employers greater opportunity to lift the pace of work, which is more output per unit of time (increasing productivity), and secondly, lowering the proportion paid in wages.

Intense competition and the tendency towards monopoly have been driving this change. The name of the game has been to increase market share and output. Increasing output and using less labour per unit (something distinct from wages paid) has led to both a fall in the rate of return.

The decline in the wages share has led to a growing gap between output and effective demand.

The rate in the creation of new value is reduced. It is what leads to the two effects mentioned above. This is how it the fall in the creation of new value happens.

Value can only be increased when human beings actively transform what nature provides and what has been provided by previous activity, into something that didn’t exist before. New value adds to the previously existing level of usefulness to human beings.

Consequently, it is the labour used, whether by hand or brain, which is the source of value. It is the transformative force. Newly created value, is therefore, determined quantity of labour used.

As this value circulates through the economy, that coming out of individual enterprises mixes into a social whole, and apportioned into wages and profits through claims on this social whole, influenced by the relative strengths of the competitors.

However, a falling rate of newly created value leads to a falling rate in the return on investments.

Stimulus spending won’t clean up this mess. A solution needs more serious economic management. The economy must be shifted from overwhelming reliance on intense competition and rising monopoly, towards one that is better suited to meet the needs of the whole of society. It must be geared to increasing value in a rational way.

In part, this means a great deal more government intervention around priority goals. But this is far from enough. Regulation by bean counters is not likely to prove to be particularly creative, dynamic, and people friendly.

A solution requires the involvement of the population, and this can only come about through building a democratic economy. A democratic economy is much more than having choice as consumers. It means having a voice in what is produced, how it is produced, and how the reward from participation are going to be shared.

The concept of a democratic economy will be covered in the next part of this series.

Leave a comment