Contributed by from Victoria and added to by Joe Montero

From the point of view of the worker, there are good reasons why it is important to defend universal superannuation. After decades of contributing to build the economy, many have been able to enjoy the reward reward after retirement.

There have been some negative sides. It is not perfect. Superannuation is subjecft to the pitfalls of the economy. It has been used to keep the wages share down and to depress the value of the age pension, to the extent that it is now one of the lowest among OECD countries.

Despite the downside, superannuation remains an important reality, where the benefits must be protected. Workers who have accumulated a nest egg over years must be protected and their future looked after. A retirement with dignity and enough to get by is a human right, and of workers and their families have come to depend on superannuation for this.

Nor is it a burden paid by employers. In reality, this has been a trade off to replace wage increases. In a very real sense, it is the workers who pay the contributions.

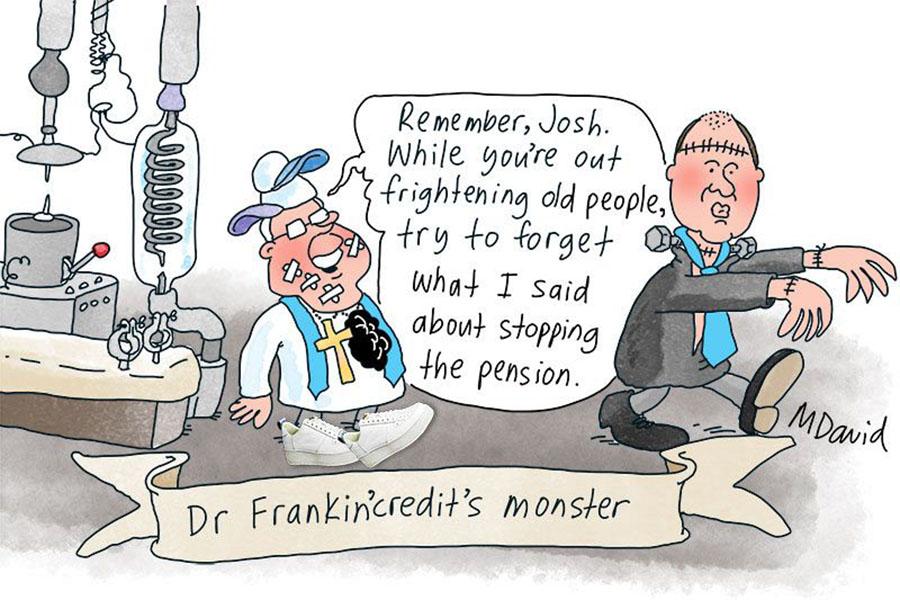

The announcement by Josh Frydenberg on the weekend of the freeze on the increase in the employer contribution form 9.5 percent of wages to 12 percent is really a form of wage theft.

In fact, the freeze has been in place since it was imposed by Tony Abbott in 2014. Today’s controversy is that it is going to continue, in conditions when so many are finding themselves worse off. Critics are saying that there should be a greater sense of humanity.

From the standpoint of the economy, superannuation funds have become a major source of investment. Sometimes this is misused by less than honest employers. On the other hand, superannuation funds provide a potential for social investment. More on this later.

According to analysis by Per Capita, the freeze has cost a worker on the median wage $4.325 per year in missed employer contributions so far. Worker productivity has increased by 10 percent over the same period. Stagnant wages, stagnant superannuation, and fewer secure jobs have sent the benefit in only one direction.

The argument has always been that this is needed to create investment and pull the economy out of hardship. If this is the case, Australia would have been in a boom some time ago. It doesn’t take a genius to work out the application of this over years hasn’t worked.

It is precisely because of ongoing wages stagnation that superannuation is no longer seen as needed to hold them down.

The inconsistency is that Morrison and then Frydenberg have gone about putting the case that holding down employer superannuation contributions, will lead to wage increases. They know very well that this isn’t the case.

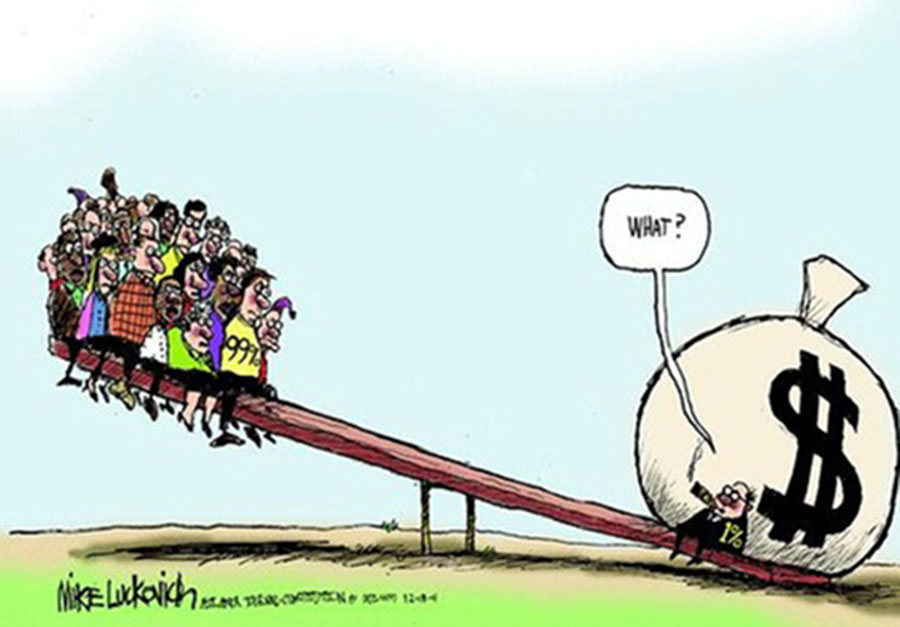

In the bigger picture, this is about shifting a greater proportion of national income to major investors. Reserve Bank figures showing dropping investment, are used to argue that increasing employer contributions would slow down the recovery form Covid-19.

It suggests that the only problem is what came with the pandemic, and it denies the longer running systemic problems, which must be faced for a real recovery. There is a clinging to the notion that the answer is in continuing to direct a higher proportion of national income upwards.

Such an obvious truth that the method fails the economy, suggests another rational lies behind the rhetoric. Based on general direction of current economic policy and the ideology behind it, the objective is to satisfy the immediate demands of major shareholders to cover their falling rate of return, and this is not necessarily about rebuilding the economy.

Opponents of this often argue, that shifting the share of national income downwards will provide stimulus, through providing more money to spend. Only to a point. This does not answer the systemic cause of the downturn. It is far more than just a problem of insufficient demand. a different approach is needed.

Superannuation funds have a potential of being a multi-billion dollar pool of capital, to counter dependence on decisions made corporate boardrooms, with the rise of a social economy.

Imagine if this was harnessed to create the infrastructure for and bring to life enterprises that better meet the needs of communities and are under the control of those who work in them and those they serve. This could provide a real solution based on using rational investment, to meet the needs of society and ensure sustainable progress. This is the bigger and longer-term battle.

For now, the defence of superannuation and demanding the lifting of employer contributions remain important.

Be the first to comment on "The present attack on superannuation must be resisted"