Contributed by Joe Montero

After a great deal of speculation, the Reserve Bank of Australia cut the interest rate from 0.75 to 0.5 percent on 3 March. The move has its fans and critics. The truth that many seem to miss the point. Whatever the intention, the power to arbitrarily effect the interest rate is seriously limited.

The Reserve Bank and government cannot get around the reality that the interest rate is not determined at will. It is dictated by the conditions of the economy. This means that there is a natural interest rate. All that human intervention can do, is artificially shift this a little for a short time, before reality asserts itself.

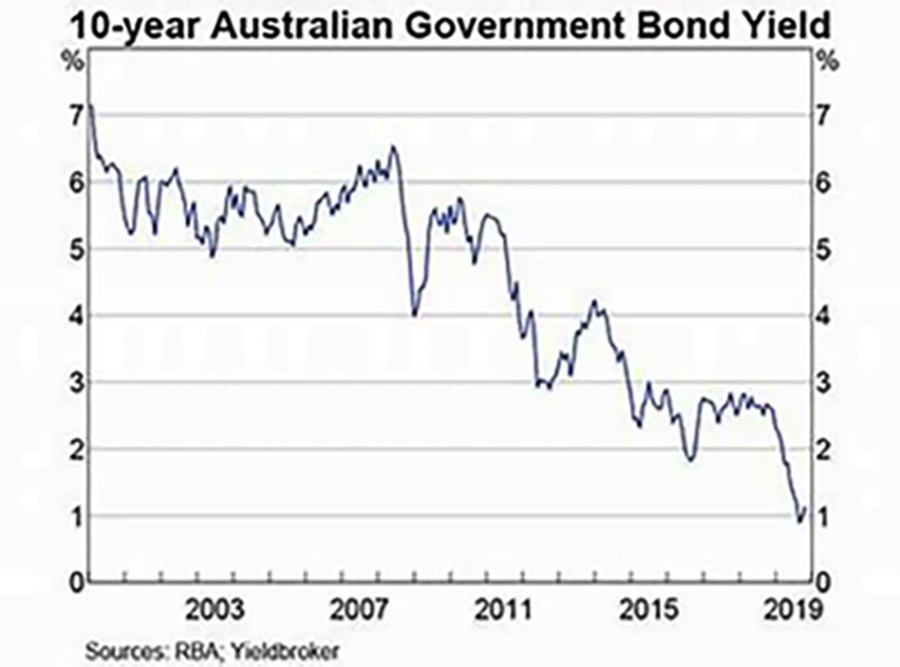

The graph below shows the longer term pattern for the interest rate, and this is a downward trajectory.

Intervention is made for one main reason. To change the quantity of money in circulation. Raising the interest, lowers the demand for money. Lowering the interest rate increases it. The current argument for lowering the rate is that consumption lags and increasing the demand for money will increase it.

The decision is made on the back of data on the level of output through the economy and consumer demand, with an eye out for the rate of inflation.

These are the factors that determine the natural interest rate, and which the authorities can only tweak a little and for only a short time.

Bonds work in the opposite way to the interest rate. In theory it can be used to take excess money out of circulation for the short-term. But it doesn’t, because in Australia’s case, most of the purchasers are from overseas. A long-term decline of the yields on bonds is making this increasingly less effective.

Lowering the interest rate makes the purchase of government bonds more enticing. Government uses the return from this to pay its way. It’s a kind of borrowing, which is paid back with a premium when they bond matures.

The final influence is the impact of the global economy and its impact through trade in goods and services and investment. These are not going so well either.

You can see from the graph below that government bond yields (return) have experienced a long term decline. Despite the decline, they have remained just higher than the interest rate, and this has meant some but very limited effectiveness. But how long will this last?

It remains that Australia’s ongoing poor performance on output and employment that has determined that we are living in an era with a historically low interest rate. Having it so low and falling further, is not a good thing. It is bad.

An economy works with money. There must therefore be a balance between the goods and services it produces, and the amount of money that is circulating. A persisting and incredibly low interest rate shows that there is way too much money in circulation.

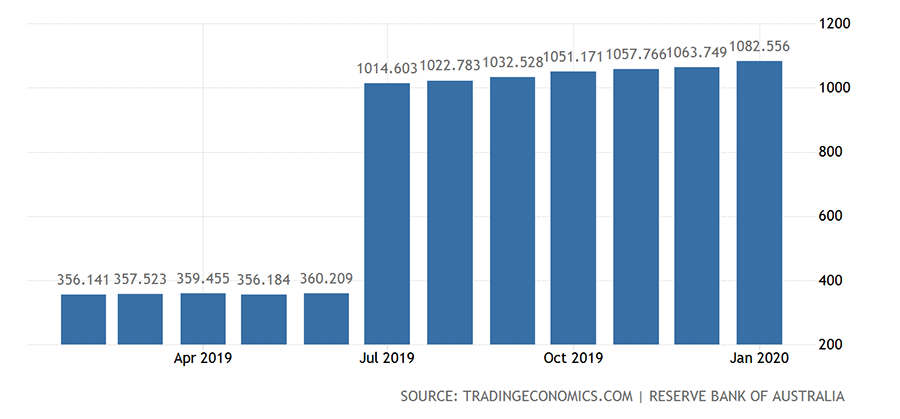

The graph below shows how much the money supply in currently increasing

Anyone who doesn’t believe this, should just consider how much more they are paying for anything than they did a couple of decades ago. Society can only buy what it produces. Imports add to this a little. But the more money relative to the quantity consumed, the lower the interest rate.

Over focus on interest avoids the real problems. Whether the Reserve Bank puts its rate up or down, does very little to change the fundamentals. Especially when the interest rate is approaching zero. Even less, when the banks have already shown that they will pass on only a small part to borrowers and lenders. They only move when it is to their benefit. The Reserve Bank’s move is rendered largely ineffective.

Instead of focusing on this short-term cosmetic adjustment of the interest rate, the government should be applying measures that go to the source. Not doing this is its failure.

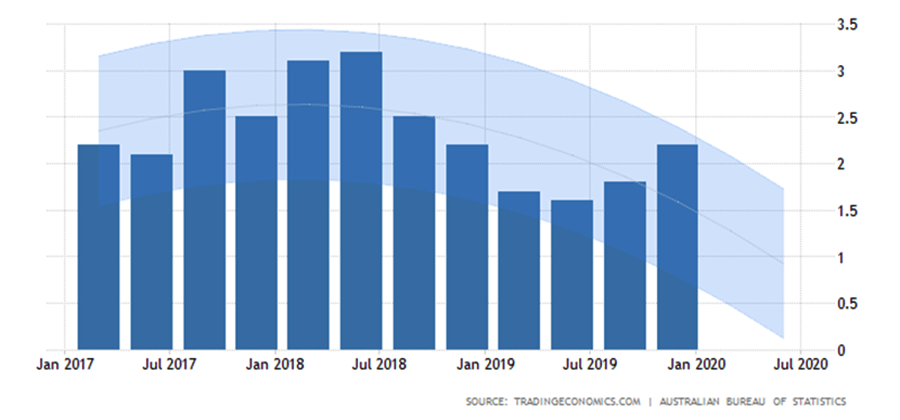

Growth as measured by Gross Domestic Product has also been shrinking, as the graph below testifies. Take note though, that this measurement includes financial transactions, or changes in ownership of assets. Taking these out would show a steeper decline. But whichever way you look at it, the news is not good.

Growing the economy requires investment. The official mantra is that the market will take care of it. It hasn’t. Goodies have been thrown at the major investors, from tax cuts, to all sorts of government support. This, the argument goes, should induce them to invest and fix all the problems.

It hasn’t worked. The evidence suggests that the more given to this quarter, the less it is likely to shift. Why should major investors bother when these handouts are the source of a good bottom line? And it is doing business without incurring costs or risk.

The graph below shows an ongoing longer term decline in private business investment. More recent figures from the Australian Bureau of Statistics (ABS) makes it clear that this decline is continuing.

The market approach is an outright failure. It can only be corrected through social intervention. Either through government, a non-private community sector, or a mix of both. This would set social priorities, like what are the most important needs and how investment should be allocated.

Intervention is needed to take control of the money supply. The excess must be taken out of the economy. A big problem is that the money supply is increased these days, by using computer technology to speed up its circulation. Increasing circulation has the same effect as printing more money.

Money supply contraction should be conditioned by two factors. The need to increase specific types of investment and need to redistribute income.

Far too high a portion of the funds made available for investment are channeled into non-productive investment. This means investment in making a return on rising prices, rather than increasing the supply of goods and services.

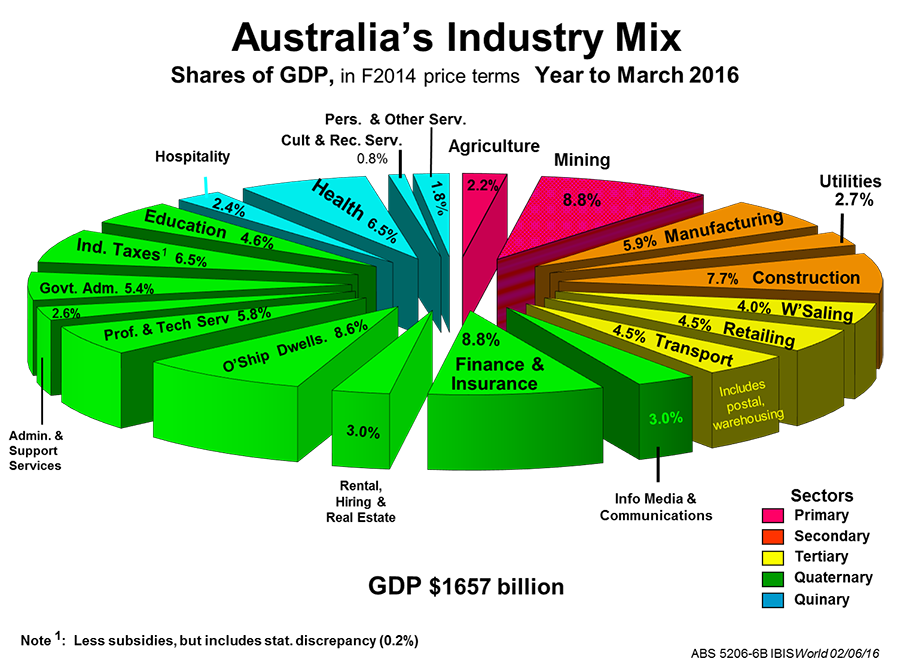

An indicator, although far from perfect is provided by the pie chart below. The green part is largely tied to the financial sector and for the most part does not result in the provision of goods and services. It accounts for about a half of GDP. This does not count trade in shares within its and the other sectors. Exact figures are not provided by the government, ABS, RBA and other institutions. Even less so in recent years.

The number one determinant of this has been a falling rate of return in the productive sector. How this has come by is something to be explained somewhere else. Secondly, the deregulation of the financial sector has done a lot to aid this shift from productive to non-productive investment.

Finance must be properly regulated. Laws may be able to limit some harmful practices. But there must also be a public investment arm, which acts as a leading force for healthy investment in genuine economic growth in line with the real needs of society, and in this age of climate change, provide a sustainable future. Investment could be channelled to assist the social sector. The resulting growth will create jobs.

Protection of jobs is important. Action mast be taken not only to safeguard existing jobs. Attention must be paid the rise of precarious work, which is bringing all jobs down.

Taking care of the supply side needs to be met by increasing the effective ability of society to buy. The only way to do this is through the redistribution of income towards the majority. Through progressive taxation and government provision, protection of wages at a level guaranteeing an acceptable standard of living. Raising Centrelink payments to a livable level would add to the economy’s capacity.

The answer is not one or another. The whole package is needed to be effective.

Our current political leaders will not even discuss it. So strong is the power of a few over our political system.

Be the first to comment on "What does the Reserve Bank’s lowering of the interest rate again really mean?"